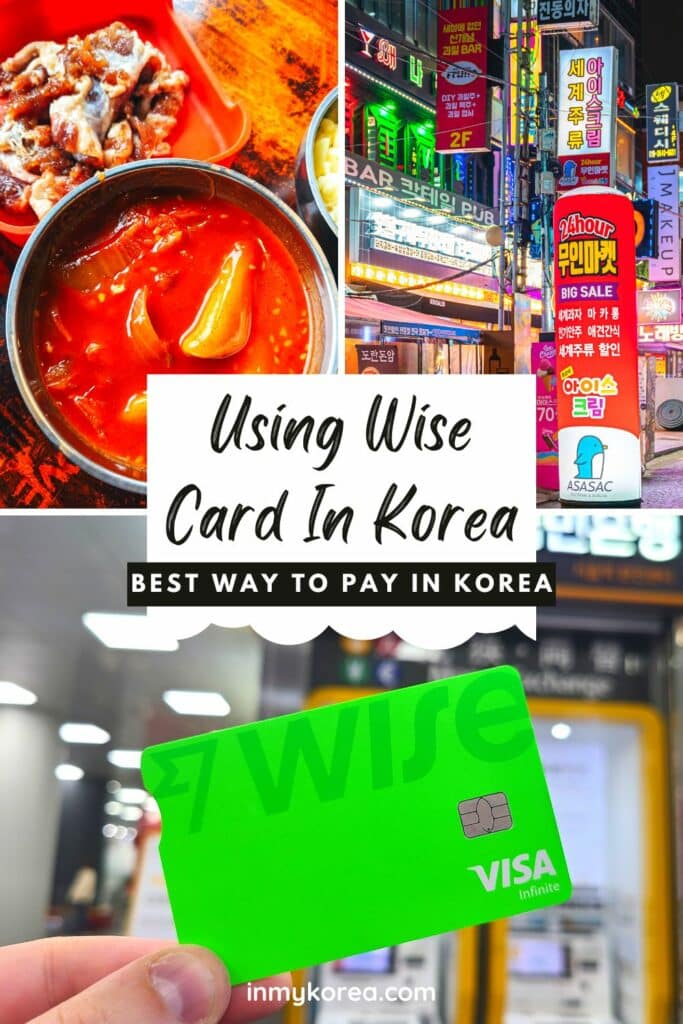

Did you know you can use the Wise card in Korea to pay most of your purchases, withdraw cash from ATMs, and as a safe alternative to your regular credit card? I use the Wise card to spend money in Korea and when I travel to other countries as it’s a great way to exchange money between over 50 currencies when you’re travelling, including Korean won.

The Wise card is a multi-currency travel money card which you can use to pay and withdraw cash in 53 currencies in more than 175 countries around the world. You can easily convert currencies by adding money from your home account and converting it in the app. Not only is it really simple, you also get the mid-market rate, which is usually much better than the rates offered by money exchanges.

As a tourist, you can use the Wise card to pay for almost all of your travel expenses in Korea, including shopping, eating out, cafes, attractions, hotels, transport, and even for online purchases. It’s as functional as your regular bank card, but with lower fees and instant currency exchange. The Wise card is also really useful for expats in Korea who want to spend money from their home countries.

Affiliate Disclaimer: This site contains affiliate links and I may earn commission for purchases made after clicking these links.

Why Use The Wise Card In Korea?

The Wise card is a prepaid travel money card and a really useful way to pay for goods and services in Korea and a way to withdraw money from Korean ATMs. It’s safer and easier than carrying foreign currency, less complicated than traveller’s cheques, and allows you to convert your money into dozens of currencies using the mid-market exchange rate.

Here’s a summary of the main benefits of using the Wise card as a travel money card in Korea. I’ll provide more details about these benefits throughout the article.

- No need to exchange cash at a money exchange: simply withdraw cash from your Wise balance at an ATM from any bank with ‘Global ATMs’.

- Pay in Korean won fee-free by card: After you convert money from your chosen currency into Korean won, you can spend money like it’s a Korean bank card with no fees.

- Easy to add money from your home account and spend in Korea: Add funds to your travel budget as you go through online transfers from your home bank account to your Wise app.

- Free withdrawals from ATMs (up to a limit): Wise doesn’t charge a fee for the first $100 of cash withdrawals per month. Travellers in Korea won’t need much cash anyway.

- No unexpected fees when you get home: Using your home bank card or credit card may charge you for using it overseas, which can give you a nasty surprise when you get home.

- Convert leftover foreign currency back to your own currency: Anything you convert into Korean won but don’t use can be converted back at the mid-market exchange rate in the app.

- Can use it to pay in other countries, too: Planning to visit Japan after Korea? Use Wise to pay for things when you’re in Japan, Thailand, Europe, and loads of other countries.

- Tracks your spending and categorises each cost: Each transaction is recorded by the app and broken down into categories so you can see where your travel budget has gone.

- Safe and secure service while travelling: You can easily freeze the Wise card if you lose it, set a password to access the app, and get a replacement card.

- Offers physical and digital card versions: Use the physical card to pay for goods and items in person or the digital version for other situations.

- Works with Apple Pay & Google Pay: Add your Wise card to your Apple Pay or Google Pay account and spend your foreign currency in Wise wherever they’re accepted.

The biggest advantages of using the Wise card in Korea that I’ve personally found is the exchange rate, which uses the mid-market rate and not the rip-off rates some money exchanges use, as well as the ability to instantly top-up my Wise balance from my UK bank account. I also use my Wise card when I travel outside Korea as I can spend my UK money or Korean money safely and easily.

If you’re interested in getting a Wise multi-currency card to pay for travel costs, use these links below:

Wise Card Vs. Credit Card & Money Exchanges

What’s the benefit of using a Wise card to spend in Korea? As mentioned above, there are many benefits of using a multi-currency card like Wise as a tourist in Korea. Whether Wise is better than your credit cards depends on a number of factors, such as if your credit card charges you a fee to use it overseas (mine does) and what rate you get when paying with your credit card.

Even if your credit card doesn’t charge a fee, banks typically give bad exchange rates when converting payments into foreign currencies. I never use my UK credit card in Korea for both of these reasons. Wise offers Visa or Mastercard services, both of which are widely accepted in Korea and can be used to pay for hotels, attractions, food, drinks, taxis, and lots more.

A Wise card allows you to withdraw cash from an ATM in Korea, which is easier than visiting a money exchange. However, Korea is quickly becoming a cash-free society and using a card to pay in Korea is more common and convenient. Public transport is moving towards only using transportation cards or apps like the T-Money card and buses have stopped accepting cash in some cities.

Learn more: If you want to read more about the best way to save money on your travel expenses in Korea, check out my article about the various ways to pay in Korea as a tourist. There’s information about the Wise card, WOWPASS, money exchanges in Seoul, and tips for spending wisely.

Planning to visit Korea? These travel essentials will help you plan your trip, get the best deals, and save you time and money before and during your Korean adventure.

Visas & K-ETA: Some travellers to Korea need a Tourist Visa, but most can travel with a Korean Electronic Travel Authorisation (K-ETA). Currently 22 Countries don’t need either one.

How To Stay Connected: Pre-order a Korean Sim Card or a WiFi Router to collect on-arrival at Incheon Airport (desks open 24-hours). Alternatively, download a Korean eSIM for you travels.

Where To Stay: For Seoul, I recommend Myeongdong (convenient), Hongdae (cool culture) or Gangnam (shopping). For Busan, Haeundae (Beach) or Seomyeon (Downtown).

Incheon Airport To Seoul: Take the Airport Express (AREX) to Seoul Station or a Limo Bus across Seoul. Book an Incheon Airport Private Transfer and relax to or from the airport.

Korean Tour Operators: Tour companies that have a big presence in Korea include Klook, Trazy, Viator, and Get Your Guide. These sites offer discounted entry tickets for top attractions

Seoul City Passes: Visit Seoul’s top attractions for free with a Discover Seoul Pass or Go City Seoul Pass. These passes are great for families and couples visiting Seoul – you can save lots.

How To Get Around: For public transport, grab a T-Money Card. Save money on Korea’s high speed trains with a Korea Rail Pass. To see more of Korea, there are many Rental Car Options.

Travel Money: Use money exchanges near Myeongdong and Hongdae subway stations for the best exchange rates. Order a Wise Card or WOWPASS to pay by card across Korea.

Flights To Korea: I use flight comparison sites such as Expedia and Skyscanner to find the best flights to Korea from any country. Air Asia is a good option for budget flights from Asia.

How To Learn Korean: The language course from 90 Day Korean or Korean Class 101 both have well-structured lessons and lots of useful resources to help you learn Korean.

Who Can Get A Wise Card?

Residents of the following countries are eligible for a Wise travel money card.

Asia: Singapore, Malaysia and Japan.

Oceania: Australia and New Zealand.

North America: Canada and the US.

Latin America: Brazil.

Europe: Austria, Belgium. British Virgin Islands. Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France (only Metropolitan), Germany, Greece, Hungary, Iceland, Italy, Ireland, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom, Gibraltar (British Overseas Territory), and the UK Crown Dependencies: Guernsey, Isle of Man, and Jersey.

Other countries in the European area: Andorra, Åland Islands, Saint Barthélemy, Curaçao, Falkland Islands [Malvinas], Faroe Islands, French Guiana, Greenland, Guadeloupe, South Georgia and the South Sandwich Islands, Cayman Islands, Monaco, Saint Martin (French part), Martinique, Montserrat, New Caledonia, Saint Pierre and Miquelon, Réunion, Saint Helena, Ascension and Tristan da Cunha, San Marino, Sint Maarten (Dutch part), French Southern Territories, Holy See, Virgin Islands (British), Wallis and Futuna, Mayotte.

The Wise multi-currency travel money card should arrive within 3 days in Singapore, 2 to 6 days in the UK, 2 weeks in Europe, Japan, or Malaysia, and 3 weeks in the US, Australia, or New Zealand.

Can Koreans get a Wise travel card? Unfortunately, people in South Korea can’t apply for a Wise travel money card right now, but if you’re an expat from one of the countries listed above, you can apply in your home country and use it when you’re in Korea (which is what I did).

How To Sign Up For A Wise Card

As long as you’re a resident of one of the aforementioned countries and you currently live in that country, you’re eligible to sign up for a Wise travel money card. Here are the steps to sign up for a Wise card:

1: Create An Account: You can do this by downloading the Wise App or on the Wise website (links below). You can create an account with your email, Google, Facebook, or Apple account.

2: Verify Your Identity: You’ll need to verify your identity to use Wise. To do this, you’ll need a valid mobile phone number, a government ID, and a bank account in the country you’re applying in.

3: Complete Account Setup: Once verified, complete your account setup and order your Wise travel money card. This should arrive within 2 weeks, but it can be fewer than that. Mine took about 3 days.

How To Add Korean Won To A Wise Card

Once your account has been setup and you’ve received your Wise card, you will need to add some money to the card and create different currency accounts. Don’t worry, this is really easy and is definitely the simplest way to create a bank account for a foreign country, which is kind of what you’re doing.

How to create different currency accounts: Open the Wise App and you’ll see your account balance at the top with available currencies below that. Scroll through your available currencies and you’ll see a button that says ‘+ Open‘ – you can use this to add new currencies to your Wise account. Select the ‘Balance‘ option to create a new bank account and select the currency you want.

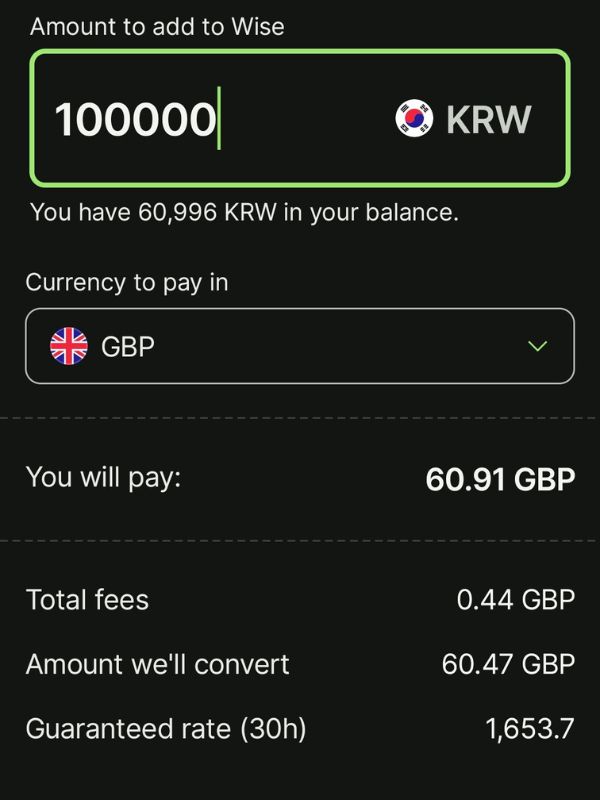

How to add Korean won to your Wise card: Open the Wise app and select the Korean won account. Click the green button that says ‘Add‘. In this screen (shown below), type the amount of money you want to add to your account and the currency you want to pay in. If you want to transfer directly from your bank account into Korean won, you can do that by selecting your home currency.

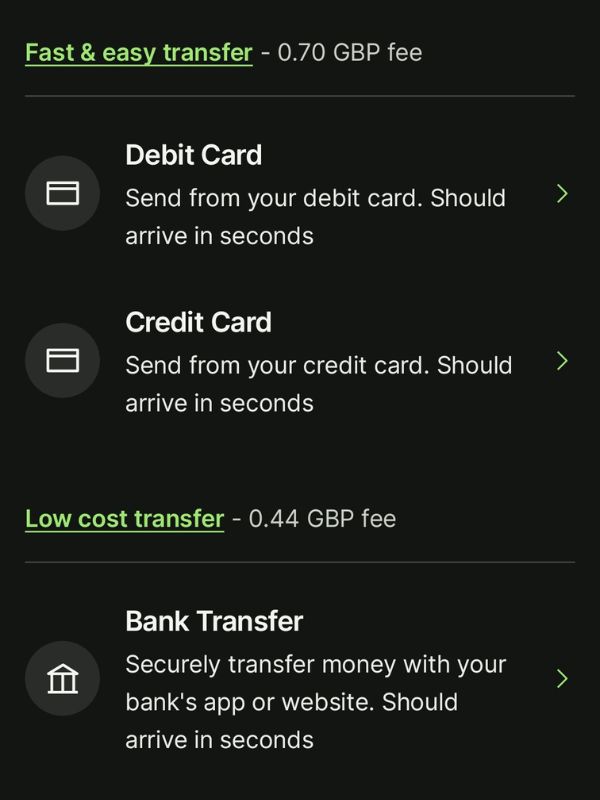

If you prefer to add money in your home currency and convert to other currencies later on, you can do this in the same way by selecting your home currency, ‘Add’ to add funds, and then bank transfer. There is no fee to do this. To convert that into Korean won, select the ‘Convert‘ button in your currency account and select the currency you want to covert into. There’s a small fee for this.

How To Activate Wise Card In Korea

Before you can use your Wise card to spend money in Korea and elsewhere, you’ll need to activate the card. You can do this by using your card to withdraw cash or pay for something using Chip and PIN. If you signed up for your Wise card in the US or Japan, you will need to activate your card before you travel. Details of this are included below.

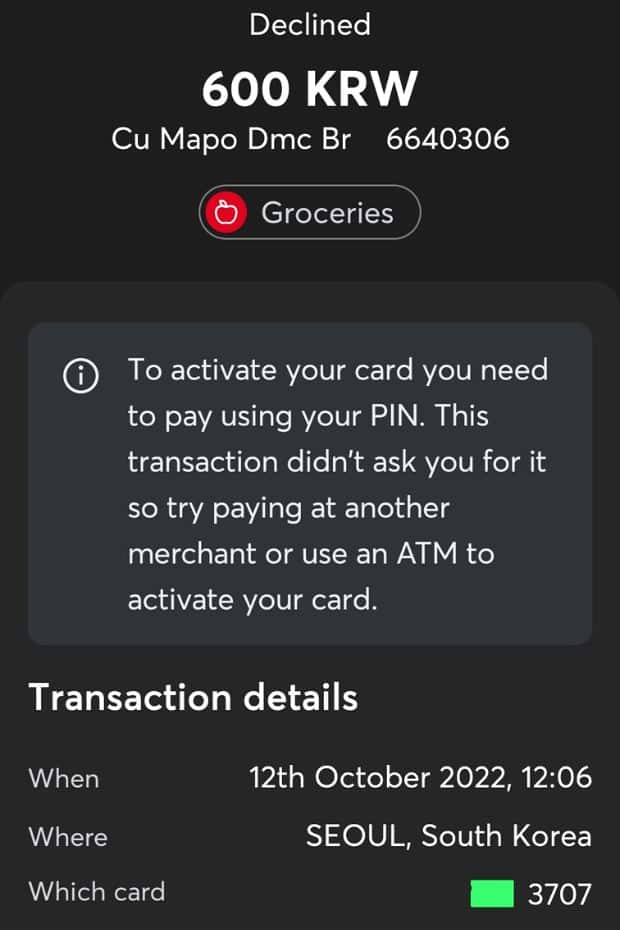

I made the mistake of not activating my Wise card before using it in Korea and it was declined when I tried to make a payment, as you can see in the image below. Fortunately, there’s a simple way to activate the Wise card in Korea at a Global ATM.

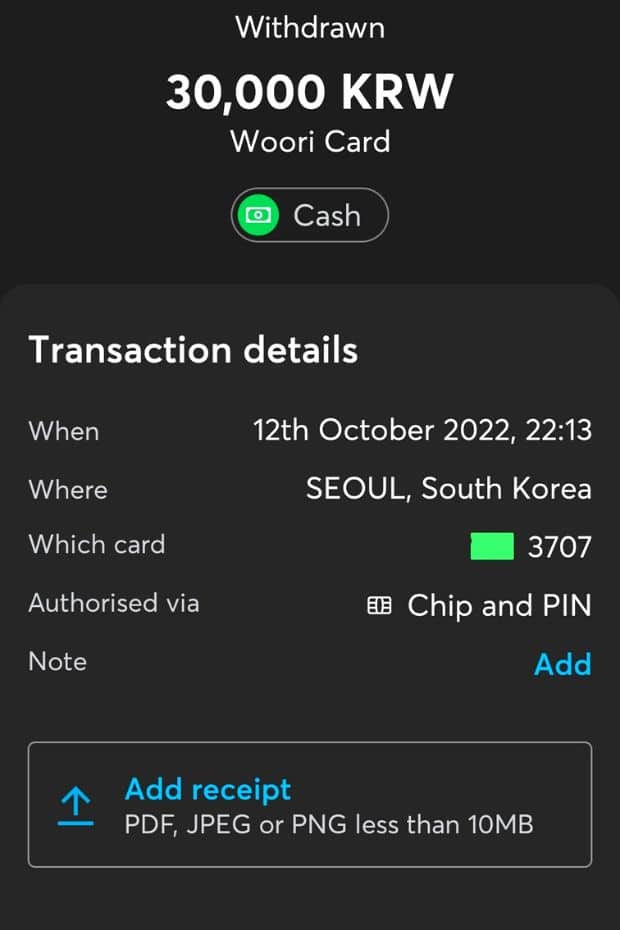

Use your Wise card in a Global ATM to activate it: This is the method I used to activate my Wise card in Korea as this method requires you to enter your PIN number. This part is very important as you must enter your PIN for the Wise card to activate. I withdrew some cash from my Wise account and after that the Wise card worked perfectly for card payments and other transactions.

Tip: You don’t have to withdraw cash to activate the Wise card, just check your balance and this will activate your card. As long as you’ve entered your PIN number, your card will be activated.

Why won’t Wise activate when paying by card? A Wise card is activated by using the PIN. Unfortunately, PIN numbers aren’t really used in Korea as a way to authenticate purchases. Purchases under ₩50,000 don’t require approval. If the purchase is over ₩50,000, then you’ll need to sign for it. This is why withdrawing cash from an ATM is the best way to activate a Wise card in Korea.

How To Activate Wise Card For US Customers

There are special rules about activating your Wise card for US customers. You need to activate your Wise card using the 6-digit PIN number that was sent with the card. Here’s how to do that:

- Go to your Wise account

- Go to Card

- Choose Activate Now

- Enter the 6-digit PIN number that’s on the letter your card came attached to.

Please note: You can only activate your Wise card when you’re in the US, so make sure you do that before you travel to Korea or use it in other countries.

How To Activate Wise Card For Japanese Customers

There are special rules about activating your Wise card if your card was issued in Japan after 27th March, 2024. You need to activate the card in Japan using the 6-digit PIN number. Here are the steps to do that:

- Go to your Wise account

- Go to Card

- Choose Activate Now

- Enter the 6-digit code that’s on the letter your card came attached to.

Please note: You can only activate your Wise card when you’re in Japan, so make sure you do that before you travel to Korea or use it in other countries.

Wise ATM Withdrawal In Korea

Travellers to Korea can use their Wise card to withdraw cash from Global ATMs instead of relying on money exchanges or airport exchanges to convert foreign currency. This is a convenient way to get cash to spend while you’re travelling in Korea and means you don’t need to bring lots of cash with you – you can withdraw it as and when you need it.

How to withdraw cash using a Wise card in Korea: To withdraw cash from your Wise account, you’ll need to go to a Global ATM as they accept foreign cards and allow cash withdrawals. You can find Global ATMs in Seoul and other major cities and they’re typically in popular tourist locations like Hongdae and Myeongdong. There are Global ATMs at Incheon Airport and other airports in Korea.

Is there a fee to withdraw cash using Global ATMs? Yes, Korean banks impose a fee of around ₩3,600 (~$3 USD) to use Global ATMs, which is something you should consider when withdrawing cash using your Wise card. It’s better to withdraw large amounts at once as the fee is set per transaction and not based on how much you withdraw. The fee is deducted from your Wise balance.

I visited several ATMs to check the fee to withdraw cash using a Wise card, including the ATM inside Seoul Station AREX terminal, and found that they all charged me a fee of around ₩3,000 to ₩3,600. Reports from other travellers in Korea who have used the Wise card at Global ATMs shows that these foreigner-friendly ATMs also charge a fee.

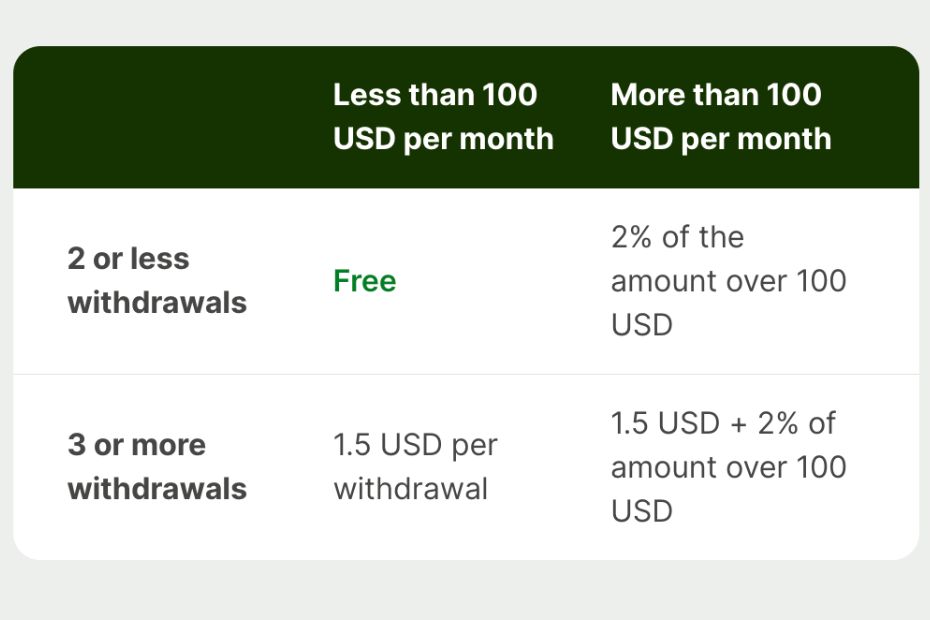

Is there a fee to withdraw cash using Wise? Wise states that you are entitled to fee-free withdrawals from ATMs up to a certain limit. The picture below shows the fees and fee-free limits for USD customers ($100), but the limit changes depending on your country. The fee-free withdrawal limit for UK customers is £200 per month. Please check the Wise website for your country to see the fees.

Should you use cash or card in Korea? As mentioned previously, Korea is a country that is becoming cash-free. You can pay for many things by card in Korea and the Wise card can be used to cover most of your costs when you are travelling. Having a small amount of cash is useful as you’ll need it to top up transportation cards (T-Money) and to pay for small purchases in markets.

Where Can You Use Wise In Korea?

As Wise cards are issued by Visa or Mastercard, two of the most widely accepted card payment methods in Korea, they can be used anywhere these cards are normally accepted. Travellers in Korea can use the Wise travel money card to pay for many things, including hotels, restaurants, transportation, trips, entertainment, cafes, and anywhere you can use a card.

Here is a summary of some of the available places you can use your Wise card in Korea:

- Hotels: Pay for your hotel in Korea when you arrive or book online.

- Shopping: From large department stores to small convenience stores and everything in between.

- Eating Out: Cafes, restaurants, and even Korean street food sellers will accept card payments.

- Entertainment: Theme parks, attractions, bars, Korean noraebangs (karaoke), and more.

- Sightseeing: Pay entry fees for famous attractions in Seoul and beyond.

- Transportation: Pay for KTX train tickets, intercity bus tickets, and taxis in Korea.

- Day Trips: You can book tours online* in your home currency or Korean won.

*online payments in Korea can be fiddly and sometimes foreign cards can be rejected due to Korea-specific security protocols or language-based technical issues.

Will you pay a fee to use Wise in Korea? No. When using your Wise card’s Korean won balance in Korea, you will only pay the price stated. Whether you spend 600 won for a bottle of water, or 60,000 won for a Korean BBQ meal, there are no transaction fees charged by Wise.

Is the Wise card a credit card? No, the Wise card is a debit card, which means you can only spend the money you have available in your Wise account for that certain currency and you can’t borrow money. If you don’t have any money in your Korean won currency account, you won’t be able to use it in Korea. However, it’s easy to top up the balance by transferring from your bank account.

Are taxes added to prices in Korea? No. When you see a price tag, that’s the price you will pay. Sales tax or other fees won’t be added on to the price, with the exception of shipping costs if buying online. Restaurant bills typically don’t include a service charge as tipping is not a Korean custom.

Where Isn’t Wise Accepted In Korea?

Like foreign debit and credit cards, the Wise travel money card isn’t guaranteed to work in every single place you try to spend money in Korea. There may be instances when the place doesn’t accept cards, such as a street food stall or food cart, even though all businesses in Korea are supposed to accept card payments. As Wise uses Visa and Mastercard, it should be accepted almost everywhere.

In my experience, there has only been one place where I wasn’t able to use my Wise card in Korea, which was an automated ticket machine at a bus terminal in Daejeon. I think these automated machines usually don’t accept foreign cards and the ticket machine at Seoul Station even says it only accepts Korean debit cards. Fortunately, you can still buy tickets at the station counter so it’s not a big issue.

Card not working because it’s not activated: If you’re having problems using your Wise card in Korea, don’t forget you need to activate it before you can use it to pay for things. As mentioned, you can do this at a Global ATM by checking your balance. However, Japanese and US customers need to activate their card before they travel to Korea as it must be done in their respective countries.

How To Use The Wise App In Korea

The Wise app is an essential part of using your Wise card in Korea and allows you to:

- Check your spending

- See your account details

- Add funds to your balance

- Send money to other people

- Transfer between currencies

- Lock the card if it’s lost or stolen

- Use digital card services

When you use the Wise multi-currency card in Korea to pay for something, you will receive a notification showing your expenditure. This is good for security, to make sure it’s not being used fraudulently, and also helps you track your spending, which can be difficult when you’re on holiday. Don’t forget, you’ll need a Korean sim card or WiFi to use your phone when travelling.

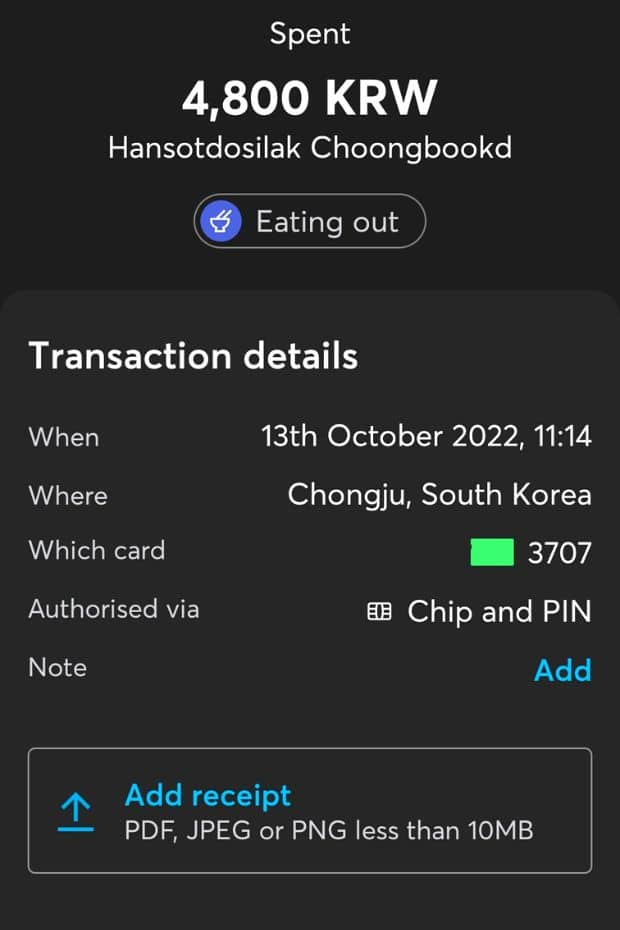

The main reason I use the Wise app when I’m travelling in Korea or elsewhere is to check that I have enough money available in my Korean won Wise balance, to add funds, to convert currencies, and to see how much I’ve spent. You can easily check your transaction history for each account and the payments are categorised according to the type of cost, as you can see in the picture below.

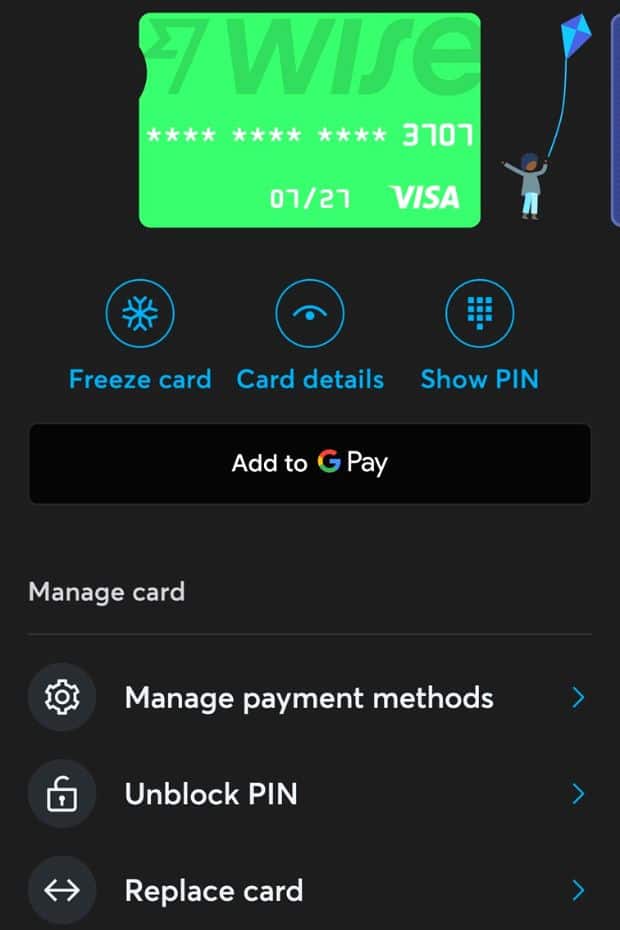

How To Replace A Lost Wise Card

If you lose your Wise card in Korea, or it gets stolen, you can use the Wise app to freeze the card instantly. Open the Wise app and select the ‘Card‘ option on the bottom menu to get to your card details. From this screen, select ‘Freeze card‘ to stop anyone using your card and protect your balance. You can order a replacement card in the same screen, which should be delivered within 2 weeks.

You can also unblock your PIN (in case you accidentally block it), view your card and PIN details, set limits on your spending, and manage where you can use your Wise card, such as whether ATM withdrawals or online payments are allowed or not. This can be useful for card safety and controlling how your Wise card is used when you’re in Korea.

Losing your card when travelling can be a big issue, but fortunately you can still use your Wise account with a digital card to spend online, with Google Pay or Apple Pay, or in store (when accepted). Select ‘Order a card‘ in the Wise app to get a digital card, which is an app-based version of your physical card. The digital card is free, issued immediately and connects to your existing Wise balance.

Please note: Only the following countries are eligible for a digital card – UK, Australia, Japan, New Zealand, Singapore, Malaysia and Switzerland, Canada, Brazil or EEA. US applicants aren’t included.

Benefits Of Using Wise As An Expat In Korea

I created a Wise card when I was home in the UK and have been using it in Korea and in other countries since 2022. As an expat in Korea since 2015, I can say that having this card has made managing my online finances so much easier. I no longer have to make expensive and time consuming bank transfers, I can manage my money through the Wise app, and I get a better exchange rate, too.

Here are some of the main benefits of using the Wise card as an expat in Korea:

1: Spend your money from your home country in Korea: Set up your Wise card for your home currency and Korean won and you can transfer money directly from your home bank account to the Korean won account and then spend Korean won in Korea with your Wise card. This can be really useful for people who are about to move to Korea and don’t have a Korean bank account yet.

2: Spend your Korean money when you travel abroad: Wise is accepted in over 175 countries and works with over 40 currencies, which means you can take it with you when you travel and pay anywhere Visa or Mastercard is accepted, which is most places. I use my Wise card as my main means of paying for things when I travel. It saves you money on foreign exchange fees and bank fees.

3: Receive money from other people: If your friends of family want to send you some money in Korea, they can send it to your Wise account in whatever currency you need. For example, you have relatives in the USA, the UK, and Australia, you can set up a Wise account for each of those currencies in the Wise app (all for free), tell them your bank details for each currency account, and they can pay you.

4: Receive payments from other countries: If you work as a digital nomad or need to be paid in a foreign currency, you can provide your bank details from Wise for that currency account. These details are found in the Wise app and come with routing numbers, BIC numbers, etc. – all you need to receive money from other countries. This saves on conversion fees for receiving foreign payments.

Expats in Korea typically still have connections in their home country, whether that’s friends, family, or business partners. Being able to receive money and spend money while in Korea with a Wise card can be a good way to buy and receive birthday presents and other gifts.

From surveys I’ve conducted from expats in Korea who use the Wise multi-currency travel money card, it seems that it’s also a good option for travelling outside of Korea. The main reason for this was that Korean banks charge high fees to exchange money or to use your Korean card overseas.

The only real criticism that other expats in Korea had about the Wise card was that, on rare occasions, the money transfers weren’t instant. Some people said that they had to wait up to 3 days for their balances to clear, which would be an issue if you need to spend money instantly.

Learn more: if you want to know more about how to transfer money to and from Korea using Wise and the best ways to receive money in Korea from abroad, check out this article about using Wise to send money to Korea.

Can You Apply For A Wise Card In Korea?

Korea isn’t one of the countries where you can sign up for a Wise card. If you’re an expat living in Korea, you’ll need to apply for a Wise card before moving to Korea. You need to be a resident of an eligible country, which you technically wouldn’t be if you’re already living in Korea long-term. However, if you’re registered in your home country with an address and bank account, you should be fine.

You’ll also need to be in the country to order a Wise travel money card, as you have to have phone number in that country and receive a call from Wise to setup your account and use the app. If you can’t receive a phone call, you won’t be able to verify your identity.

My Experience Using Wise In Korea

I picked up a Wise card in the UK and have been using it in Korea since 2022.

Here are some of the good things I’ve found out about the Wise card:

- It works in most places: As mentioned, I’ve only had one payment rejected, which was at a bus terminal ticketing machine. Everything else has been really smooth.

- It has saved me money: Transferring money between the UK and Korea isn’t cheap and the Wise multi-currency travel money card is certainly a much cheaper way to get my UK money into Korea.

- More convenient for transfers: If I want to send money from the UK to Korea, I need to do it through my banking app in the UK, which can require a phone call to approve it. Using Wise, I can skip that and it’s done instantly and hassle-free.

- Helps me track my spending: I love the Wise app, it’s much better than my UK and Korean banking apps and shows me what I’ve spent money on more cleary.

- Can use it when travelling: I use my Wise card when to avoid bad exchange rates when converting cash and high fees for using my UK card overseas.

And here are some of the downsides of having a Wise card in Korea:

- Can’t always withdraw cash from an ATM: I live in Daejeon and there aren’t many Global ATMs in this area, which makes it hard to withdraw cash from my Wise card. I don’t need to withdraw cash, but if I did, I’d need to find a Global ATM to do so.

- Interferes with my other contactless cards: I have a contactless Korean bank card in my wallet which I use to pay for things. As the Wise card is also a contactless payment card, it confuses the card reader and I have to take my Korean card out of my wallet to use it. It’s not a big hassle, but it’s worth considering.

Generally, the Wise card has been a great advantage to my range of payment options in Korea and helps me manage my money in the UK and Korea more conveniently and cheaply. As a tourist in Korea, the Wise card would be a very useful addition to anyone’s travel payment options and a way to avoid using money exchanges, paying high overseas fees, and worrying about how much money to bring.

Frequently Asked Questions

Finally, here are a few FAQs about using the Wise card in Korea, in case the above information didn’t cover enough for you. This is based on my personal experience, feedback from other people who have used the Wise card in Korea, and research from other websites.

Can you use the Wise card in Korea?

The Wise card can be used in Korea as the South Korean won is a currency available for purchase using the Wise multi-currency account. Payments using the Wise card can be made for a range of goods and services, including hotels, transportation, eating out, shopping, and sightseeing.

How do you activate the Wise card in Korea?

To activate a Wise card, you need to use the PIN to certify a transaction. However, Korea doesn’t use PIN certification and relies on contactless or CHIP-only payments. Therefore, it is necessary to withdraw cash from an ATM, which requires you to enter your PIN number. This will activate your Wise card.

Is Korean Won Available With A Wise Travel Card?

South Korean won is one of the currencies available with a Wise travel card. It is possible to convert to and from Korean won and to use Korean won as you travel in Korea.

Is there a fee to use the Wise card?

There is no fee for the Wise card when paying in shops and stores. However, there are fees for converting one currency to another, for withdrawing cash from ATMs after the free monthly allowance, and for some methods of adding money to your Wise account.

Can I Apply For A Wise Card In Korea?

The Wise card is currently not available to residents of South Korea. It is available in dozens of other countries and if you’re a resident of one of those countries, you can apply for the Wise card and then take it to Korea when you travel.

Is the wise travel money card cheaper than Incheon Airport money exchange?

Generally, the exchange rate offered with the Wise travel money card is better than most money exchanges and in particular is better than the rate charged at Incheon Airport. Money exchanges at Incheon Airport charge around 2.5% to exchange money, but Wise can be as low as 0.7%.

Liked This? Pin It For Others

If you enjoyed reading this article, then please share this with your friends on Pinterest.

Hey Joel. I just tried activating my Wise card and found out that just checking your balance through a Global ATM works too to activate the card. Even Global ATM charges a 3600 won to 4200 won fee for withdrawal so I wanted to avoid that and tried balance enquiry. It worked so thought you might want to add it in to help the next person reading this.

Hi Adrian, thanks so much for the update and for reading my article. I wasn’t aware that just checking the balance would work too and I’ll definitely add that in soon. Appreciate the tip!

Hi Joel, do you have any suggestion on choosing between the Wise card or Wowpass? Thank you.

Hi, they’re both good options for paying for things in Korea, but which one is best for you depends on a few things. If you’re looking for a one-off card that you can use just for a trip to Korea, then the WOWPASS is fine. However, if you’re looking for a card that you can use in other countries and spend more than 1,000,000 KRW with (that’s the limit of the WOWPASS), then the Wise card will be better.

I use my Wise card when I travel to other countries and I can top it up with my UK bank account, which is useful to spend my UK money in Korea or abroad. They both have good apps that will allow you to track your spending. I’m actually writing an article about payment options right now and I’ll post it tomorrow. Check it out for more info.